Parwaz Card Loan for Overseas Students Complete Apply Guide 2025. Many Pakistani students dream of studying abroad in the UK, USA, Canada, Australia, or the Gulf but face a major challenge: financial limitations. The Parwaz Card Loan for Overseas Students has been launched by the Government of Pakistan to make those dreams achievable.

This guide explains everything about the Parwaz Card Loan 2025 eligibility, requirements, benefits, and a complete step-by-step process to apply online.

What is the Parwaz Card Loan for Overseas Students?

The Parwaz Card Loan is a government-backed financial aid program introduced to support Pakistani students who secure admission in international universities but lack the funds to start their journey.

It’s more than just a loan — it’s an educational empowerment tool that provides interest-free or low-interest financing for study abroad purposes.

Once approved, students receive a Parwaz Card — a digital financial card similar to a debit card — to pay for:

- University admission and tuition fees

- Visa processing and flight tickets

- Initial accommodation and hostel charges

- Emergency or living expenses abroad

Key Highlights of the Parwaz Card Loan 2025

| Feature | Details |

|---|---|

| Program Name | Parwaz Card Loan for Overseas Students |

| Announced By | Government of Pakistan |

| Purpose | Financial aid for students studying abroad |

| Loan Type | Interest-free / low-interest educational loan |

| Eligibility | Pakistani citizens with confirmed foreign admission |

| Partner Banks | NBP, BOP, ABL, and others |

| Loan Amount Range | Up to PKR 2 million |

| Repayment | Starts one year after completion of studies |

| Application Mode | Online & Offline through partner banks |

Eligibility Criteria — Who Can Apply for the Parwaz Card Loan?

To ensure fair distribution, only eligible students can apply. Below are the conditions you must meet before applying:

Basic Eligibility

- Must be a Pakistani citizen with a valid CNIC or B-Form.

- Age must be between 18 and 35 years.

- Must hold an admission offer letter from an HEC-recognized foreign university.

- Should belong to a middle-class or low-income family.

- Both male and female students can apply equally.

Special Considerations

- Students with partial scholarships can also apply if their funding does not cover all costs.

- Priority is given to fields like STEM, health sciences, engineering, and IT, which contribute to national growth.

- Applicants from underserved regions (like Balochistan, interior Sindh, and South Punjab) may get preference.

Benefits of the Parwaz Card Loan for Students

This scheme is designed to provide maximum relief, transparency, and flexibility to students and their families.

- Interest-Free Loan Options — Especially for low-income families.

- Easy Installments — Repay after completing studies.

- Transparent System — Direct payments to universities to prevent misuse.

- Multi-Purpose Use — Pay tuition, flight, visa, and accommodation.

- Foreign Currency Support — Avoid currency exchange issues.

- Confidence for Parents — Reduces financial pressure and risk.

- Nationwide Access — Apply through multiple banks and online portals.

Documents Required for Parwaz Card Loan Application

Before applying, prepare all your documents to ensure a smooth process. Missing or incorrect papers can delay approval.

| Required Document | Details / Notes |

|---|---|

| CNIC or B-Form | Must be valid and readable |

| Passport | At least 6 months validity |

| Admission / Offer Letter | From an HEC-recognized university |

| Educational Certificates | Matric, Intermediate, Bachelor (attested) |

| Parent/Guardian Income Certificate | For means-testing verification |

| Bank Statement | Optional but recommended |

| Visa or I-20 Document | If already issued |

| Photographs | Two recent passport-size photos |

Tip: Keep scanned soft copies (PDF/JPEG) ready for online submission.

Step-by-Step Application Process for Parwaz Card Loan 2025

The Government of Pakistan has simplified the procedure to make it hassle-free. Follow these steps carefully:

Step 1 – Visit the Official Portal

Go to the Parwaz Card Loan official website or visit your nearest partner bank branch (NBP, BOP, ABL).

Step 2 – Download or Collect the Application Form

Fill the Parwaz Card Loan Application Form completely. Use accurate data that matches your CNIC and university documents.

Step 3 – Attach the Required Documents

Attach attested copies of your CNIC, admission letter, passport, and income proof.

Step 4 – Submit the Form

You can submit the form online through the official website or manually at a partner branch.

Step 5 – Verification Process

Your application will be verified through NADRA, HEC, and the bank’s internal check.

Step 6 – Approval and Card Issuance

Once approved, you’ll receive the Parwaz Card, which you can use for all approved education-related expenses abroad.

Step 7 – Loan Disbursement

Funds will be loaded onto your card or directly sent to the university account for transparency.

Partner Banks and Offices for Application

Currently, the Parwaz Card Loan Scheme operates in collaboration with several government and private sector institutions.

| Bank Name | Application Channel |

|---|---|

| National Bank of Pakistan (NBP) | All major branches nationwide |

| Bank of Punjab (BOP) | Regional education financing centers |

| Allied Bank Limited (ABL) | Selected branches in major cities |

| Habib Bank Limited (HBL) | Expected to join soon |

| Overseas Pakistanis Foundation (OPF) | Support for overseas visa verification |

Parwaz Card Loan Amount and Repayment Terms

The scheme offers flexible loan limits depending on your education needs.

| Type of Expense | Maximum Limit (PKR) | Repayment Start |

|---|---|---|

| University Tuition Fee | Up to 2,000,000 | After 1 year of studies |

| Air Ticket & Visa Fee | Up to 500,000 | After 1 year of studies |

| Hostel / Accommodation | Up to 300,000 | After 1 year of studies |

| Miscellaneous / Emergency | Up to 200,000 | After 1 year of studies |

Note: Repayment begins one year after graduation or when the student secures employment, whichever comes first.

Key Tips Before Applying for the Parwaz Card Loan

- Ensure your foreign university is HEC-recognized.

- Prepare all documents before applying.

- Do not provide fake income details — strict verification applies.

- Apply 2–3 months before visa processing.

- Keep photocopies of every submitted paper.

- Track your application status online for updates.

How Parwaz Card Loan Supports Overseas Education

The program directly supports Pakistan’s national education and skill export policy, helping students gain global exposure and contribute to Pakistan’s economy.

- Encourages knowledge transfer from developed countries.

- Reduces brain drain by promoting return-to-serve incentives.

- Builds global Pakistani alumni networks for future collaborations.

- Enables digital remittance stability, as graduates later earn abroad.

Common Challenges Students Face

Despite its benefits, students may face some initial challenges like:

- Delay in loan approval due to incomplete documents.

- Limited bank participation in smaller cities.

- Lack of awareness about repayment structure.

However, with proper documentation and guidance, these hurdles can easily be overcome.

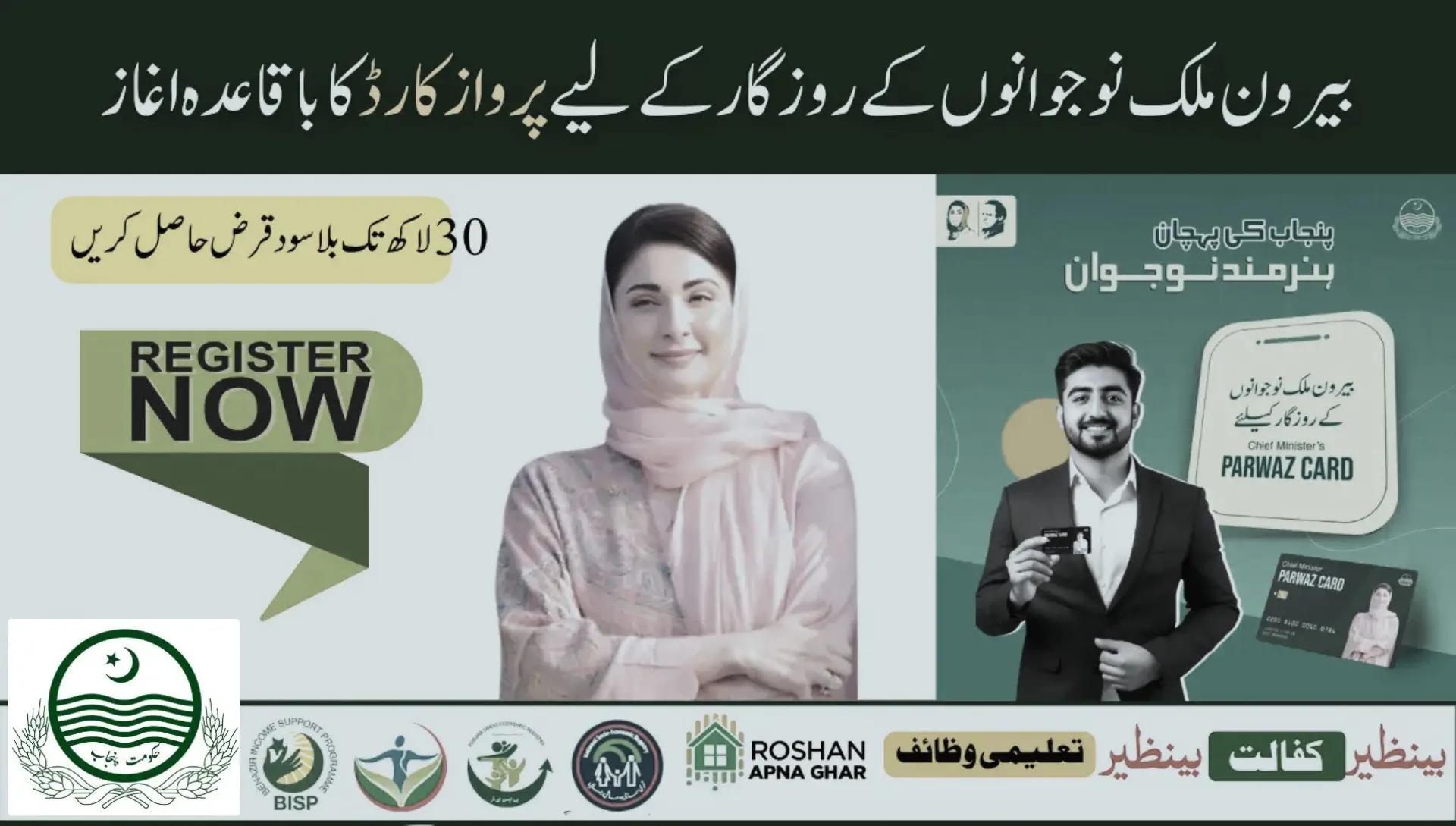

Government’s Vision Behind Parwaz Card Loan

Under the leadership of Chief Minister Maryam Nawaz and the Government of Pakistan, this scheme is part of a larger youth empowerment plan, including:

- Parwaz Employment Program

- Asaan Karobar Card

- CM Green Tractor Scheme

- CM Education Support Loans

Together, these programs aim to uplift youth through financial inclusion and provide pathways for global education and entrepreneurship.

FAQs

Q1: What is the Parwaz Card Loan for Overseas Students?

It’s a government-supported loan program providing financial assistance to Pakistani students studying abroad in countries like the UK, USA, Canada, and Australia.

Q2: Is the Parwaz Card Loan interest-free?

Yes, it offers interest-free or low-interest loans, especially for students from middle- and lower-income families.

Q3: How can I apply for the Parwaz Card Loan?

You can apply through the official Parwaz Card portal or partner banks such as NBP, BOP, and ABL by submitting the required documents.

Q4: Can scholarship students apply too?

Yes. Students who receive partial scholarships can still apply for financial coverage of remaining costs.

Q5: When do I start repaying the loan?

Repayment starts one year after graduation or once the student begins earning.

Conclusion

The Parwaz Card Loan for Overseas Students 2025 is a game-changing initiative that opens doors for thousands of Pakistani youth to pursue their education abroad without financial worries.