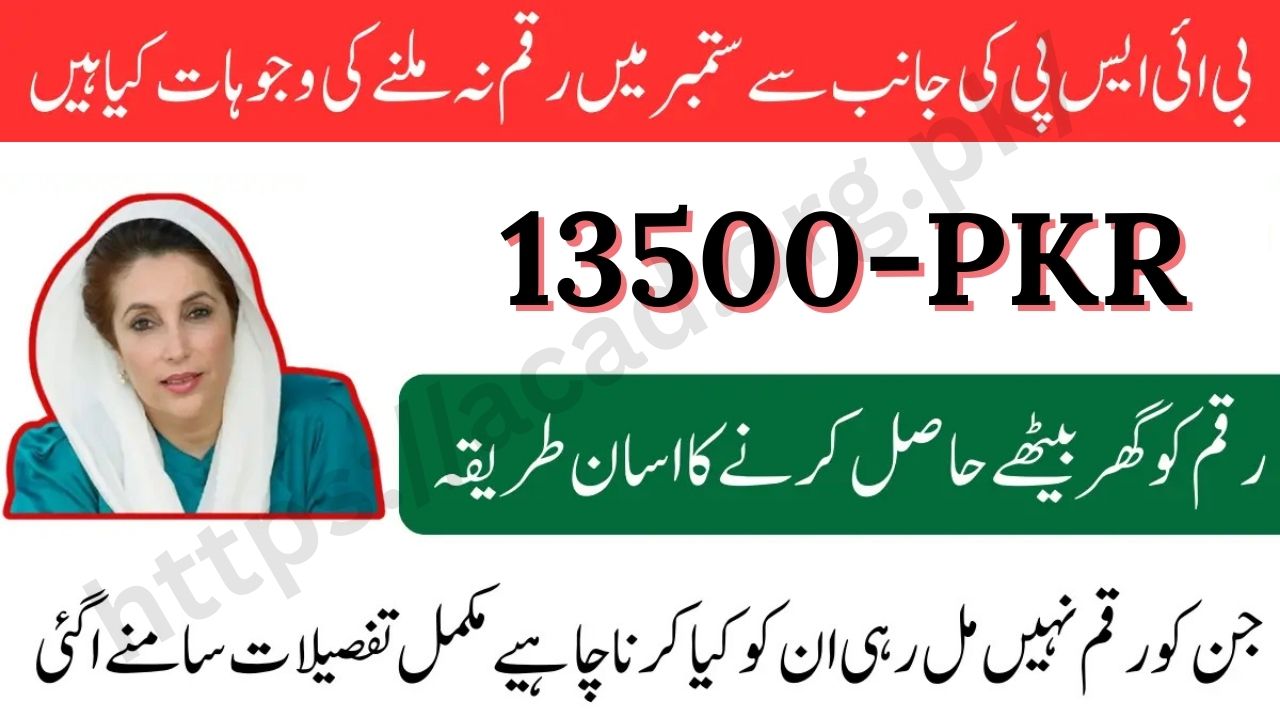

In a groundbreaking move to empower women across Pakistan, a new mobile wallet payment scheme has been launched. The initiative offers a significant payment of 13,500 for women in 12 districts of Punjab. This new development promises to not only boost economic stability but also drive financial inclusion, making it easier for women to manage their finances and access essential services.

What Is the 13,500 Payment Scheme?

The newly introduced 13,500 payment scheme is designed to support financially vulnerable women, particularly in rural areas. With the backing of the government, the initiative provides a substantial financial cushion, helping women gain better control over their economic well-being.

How Does the Mobile Wallet Work?

The payment is distributed via a mobile wallet, an increasingly popular method for conducting financial transactions in rural areas. Mobile wallets have become essential tools for millions, offering easy access to funds without the need to visit a bank. Women can use these wallets to pay bills, buy groceries, and even save for the future.

Benefits of the Scheme

- Financial Independence: By offering direct mobile payments, this scheme reduces dependency on traditional financial institutions, giving women greater control over their money.

- Boosting Local Economies: With an injection of 13,500, local businesses will benefit from increased consumer spending, helping to stimulate economic growth.

- Empowering Rural Women: This scheme is a step forward in empowering rural women, helping them break barriers and take part in the mainstream economy.

Role of Mobile Wallets in Financial Inclusion

In Pakistan, mobile wallets have emerged as a game-changer for financial inclusion, particularly for women in rural communities. Traditional banking has often been out of reach due to physical distance, societal norms, and lack of financial literacy. Mobile wallets solve this problem by offering an easy-to-use platform for accessing, saving, and transferring money.

How to Access the 13,500 Payment Scheme?

Eligible women can sign up for the payment scheme via the official mobile wallet platform. The government ensures a streamlined process to make the disbursement quick and easy. To participate, individuals must register with their CNIC and other required documentation.

The Future of Mobile Payments in Pakistan

With the success of initiatives like this, Pakistan is poised to experience further growth in mobile payments. Financial technology (fintech) is rapidly transforming the way people handle money, and women, in particular, are benefitting from these digital solutions.

FAQs

How can I register for the 13,500 payment scheme?

You can register for the scheme through your local mobile wallet provider by submitting the required identification documents.

What can I use the 13,500 for?

The 13,500 can be used for everyday expenses, including groceries, bill payments, and more, directly from your mobile wallet.

Is the mobile wallet accessible for women in all provinces?

Currently, the scheme is available in 12 districts of South Punjab, but plans are underway to expand it nationwide.

Conclusion

The launch of the 13,500 payment scheme marks a significant milestone in Pakistan’s journey toward digital financial inclusion. By leveraging mobile wallets, women now have an opportunity to access financial resources directly at their fingertips, making it easier for them to manage their finances and improve their economic standing. This scheme not only benefits individual women but also contributes to the broader economic growth of rural areas in Pakistan.